FinTech to a Gamified Community App: a pivot for the ages.

GroundSwell is an action organization with a dream of robbing from the rich to give to the poor. The startup approached our team with an opportunity to give consumers the option of enriching a great charity instead of the usual banking industry juggernauts.

Every time one of us uses a credit or debit card to pay for goods and services, your data flows through a chain of custody of companies that facilitate that transaction. For example, your sensitive data may be collected by a “payment gateway” from your bank, sent over the Visa network to the merchant’s banking institution, where it’s processed by a vendor like SAP, and finally the bank transfer is made.

Strategy Statement

Non-profit organizations must find novel ways to raise funds to sustain their mission. The emerging market demographic—millennials—care deeply for charitable causes but lack disposable income.

The GroundSwell Visa Debit Card program allows non-profit organizations to appeal to donors of all socioeconomic levels, crowd-sourcing microdonations that otherwise would have been absorbed by bank fees.

Existing Conventions Yielded Conventional Solutions

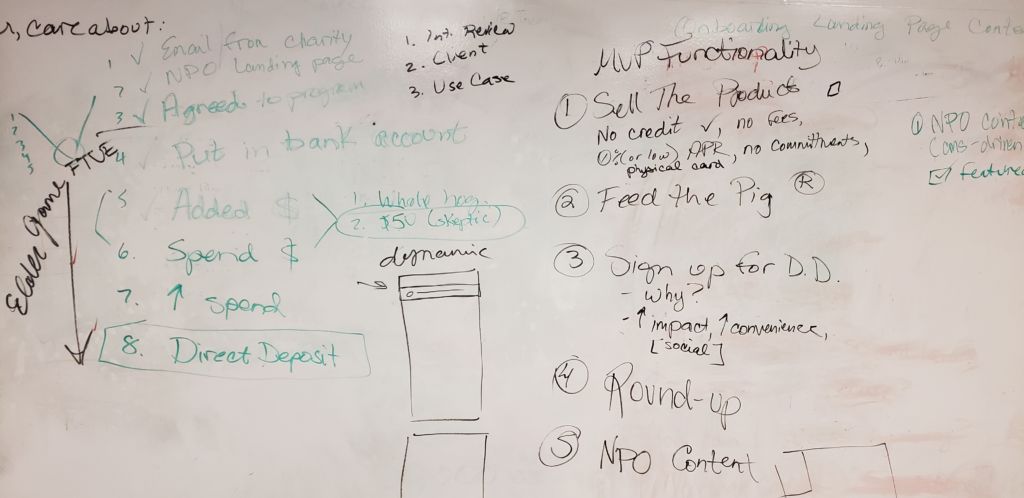

In our initial kick-off session, I defined an aggressive conversion funnel for our business case. Our ideal scenario had users marching through the following goals:

- Complete user registration,

- Submit checking account details,

- Deposit money from checking account into GroundSwell Visa debit card account,

- Enter

the the GroundSwell card number into an online merchant account, e.g. Amazon.com, - Sign up in the RoundUp program to donate the change to your

favorite charity every time you make a debit transaction, - Share the platform,

- Use the GroundSwell card to make a purchase,

- Opt into automatic account reload, based on a regular date or minimum balance,

- Start using the GroundSwell card for everyday transactions,

- Enter

the the GroundSwell card number intoa automatically-renewing subscription service, e.g. Netflix, - Sign up for direct payroll deposit, using the GroundSwell debit card account as the primary checking account.

To grease this funnel, I planned a best-practice banking app to meet (and exceed!) the expectations of an educated, digitally-native target audience. We crafted a thoughtful first-time user experience (FTUE) to delight and educate our users. Our interaction design system was based on the fundamentals of operant conditioning, gently nudging and shaping user actions to overcome the steep barrier-to-entry associated with many of our conversion goals.

Constraints are the Mother of Invention

The GroundSwell platform hit a challenging hurdle in 2018 when our payment gateway vendor failed to provide any of the APIs the team had bet on while defining our assumptions. A sincere re-factoring had to take place: placed the focus on providing value to the donor base by emphasizing community-building and mission-building mechanics. The design team returned to the business goals to inform a complete re-factor of the MVP’s functionality.

Back to the drawing board…

I led an afternoon workshop with the design team to brainstorm novel solutions to the GroundSwell business case. We carefully revisited the business needs for this early phase of the start-up’s development.

0.1 Release, Product Goals:

- Increase donor base,

- Educate donor base as to which actions are most beneficial to the nonprofit,

- Imbue community with intrinsic motivation to continue to engage with and use GroundSwell to contribute to a nonprofit,

- Convert GroundSwell users to GroundSwell program evangelists,

- Deploy value-add marketing & communication channels to nonprofit partners, allowing the organizations to reach a new donor base,

- Onboard new nonprofit organizations.

0.1 Release, UX Strategy

Our workshop yielded the following design principals.

- The primary emphasis of the GroundSwell platform is to foster a community of action-oriented, purpose-driven program evangelists.

- The number-one goal of the platform is to reclaim the maximum possible passive revenue from banking institutions, diverting it toward philanthropic efforts, instead.

- The number-one execution of that goal relies on empowered, educated, digitally-engaged users that share and champion the platform.

- We must de-emphasize the value expected by our user base as a modern banking application, as we are unable to meet industry-standard data freshness due to technical limitations in this phase of product development.

- We must then emphasize the value we offer as a community-building tool that drives intrinsic motivation in our user base to engage actively and directly with the charities that need them.

We had to really push our design thinking to come up with a functional way to implement our design principals, staying within the tight boundaries of MVP scope, execute our solution to the level of aesthetic fidelity we expect within scope, and do so in a way that adequately tests the foundation of our design principals, collecting the right kind of usage data from our MVP interface.

3… 2… 1… Launch MVP!

The MVP platform is launching in March 2019 with a few nonprofit organizations piloting the program. Rolling enhancement releases are scheduled to stabilize and enhance existing features, introduce new functionality like program rewards, user groups and community features, and increasingly sophisticated gamification.

Our UX team plans to carefully monitor the live usage data to inform our design approach as we phase in banking features.